How Long Can You Go Without Paying Property Taxes In Illinois . What is a property tax exemption? If you qualify for an exemption, it allows you to. How long can you go without paying your property taxes? Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,. You can lose your home or property if you don’t pay your residential property taxes. A property tax exemption is like a discount applied to your eav. Because property tax liens have priority over other liens, the lender or. When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Fulfilling a promise of offering property tax relief for illinoisans, gov. Exactly how long you can go without paying your property taxes varies. Failing to pay property taxes when due can mean: Usually, a property won't go to tax sale if the home is mortgaged.

from www.illinoispolicy.org

A property tax exemption is like a discount applied to your eav. You can lose your home or property if you don’t pay your residential property taxes. Because property tax liens have priority over other liens, the lender or. How long can you go without paying your property taxes? What is a property tax exemption? When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. Fulfilling a promise of offering property tax relief for illinoisans, gov. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Exactly how long you can go without paying your property taxes varies. Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,.

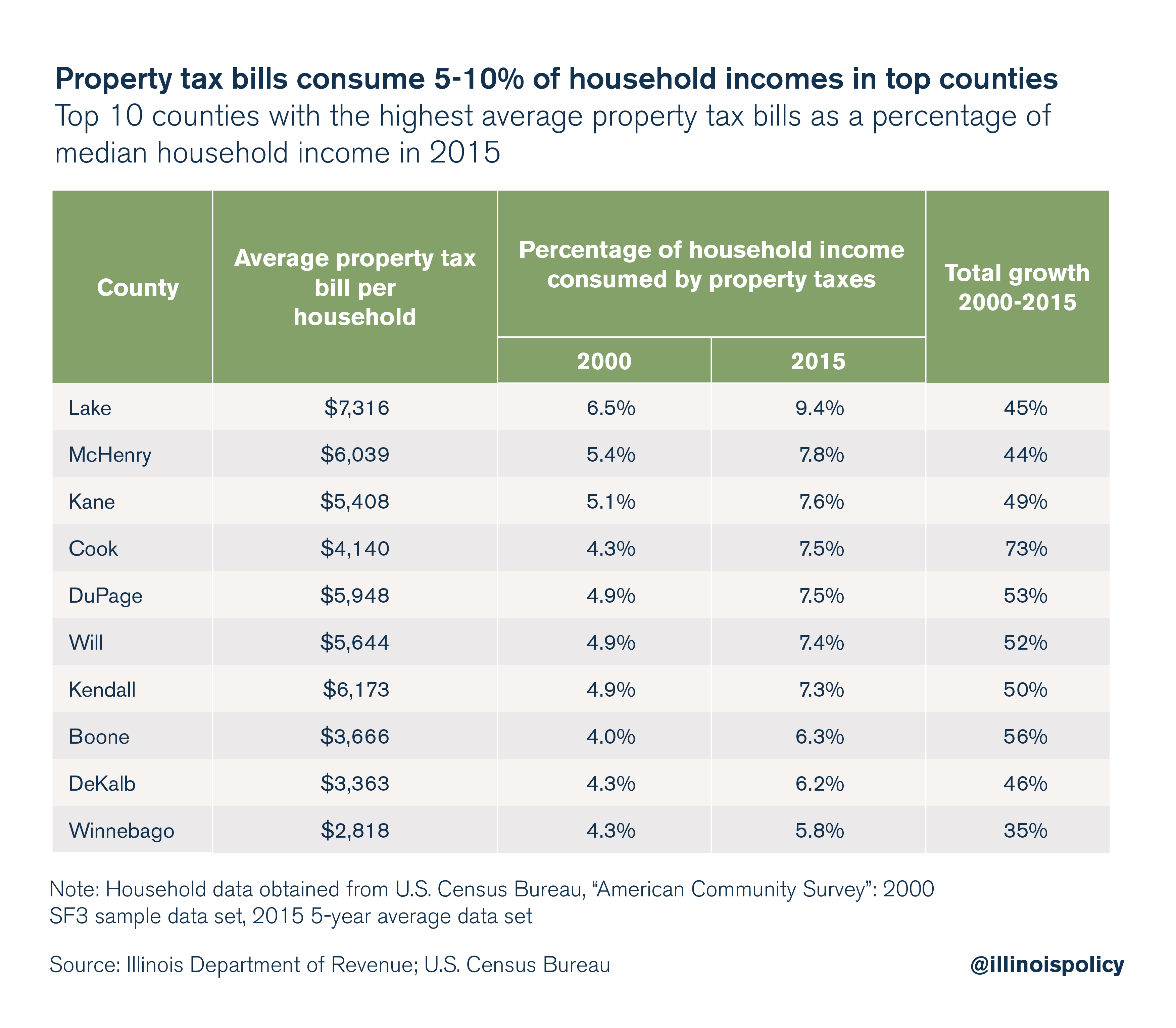

Property taxes grow faster than Illinoisans’ ability to pay for them

How Long Can You Go Without Paying Property Taxes In Illinois The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Failing to pay property taxes when due can mean: What is a property tax exemption? If you qualify for an exemption, it allows you to. Because property tax liens have priority over other liens, the lender or. You can lose your home or property if you don’t pay your residential property taxes. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. Usually, a property won't go to tax sale if the home is mortgaged. Exactly how long you can go without paying your property taxes varies. A property tax exemption is like a discount applied to your eav. How long can you go without paying your property taxes? Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,. Fulfilling a promise of offering property tax relief for illinoisans, gov.

From aggreg8.net

What Happens if You Don't Pay Property Taxes in Texas? aggreg8 How Long Can You Go Without Paying Property Taxes In Illinois You can lose your home or property if you don’t pay your residential property taxes. Exactly how long you can go without paying your property taxes varies. A property tax exemption is like a discount applied to your eav. Usually, a property won't go to tax sale if the home is mortgaged. Failing to pay property taxes when due can. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.garybuyshouses.com

How long can you go without paying property taxes in Utah? How Long Can You Go Without Paying Property Taxes In Illinois Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,. When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. What is a property tax exemption? You can lose your home or property if you don’t pay your residential property. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.hechtgroup.com

Hecht Group The Consequences Of Not Paying Property Taxes How Long Can You Go Without Paying Property Taxes In Illinois What is a property tax exemption? Fulfilling a promise of offering property tax relief for illinoisans, gov. Because property tax liens have priority over other liens, the lender or. A property tax exemption is like a discount applied to your eav. Usually, a property won't go to tax sale if the home is mortgaged. Exactly how long you can go. How Long Can You Go Without Paying Property Taxes In Illinois.

From skydanequity.com

How to Resolve Your Struggle With Illinois Property Taxes SkyDan How Long Can You Go Without Paying Property Taxes In Illinois Usually, a property won't go to tax sale if the home is mortgaged. Because property tax liens have priority over other liens, the lender or. Fulfilling a promise of offering property tax relief for illinoisans, gov. A property tax exemption is like a discount applied to your eav. Exactly how long you can go without paying your property taxes varies.. How Long Can You Go Without Paying Property Taxes In Illinois.

From leilanipuente.blogspot.com

how long can you go without paying property taxes in missouri Leilani How Long Can You Go Without Paying Property Taxes In Illinois Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,. How long can you go without paying your property taxes? Exactly how long you can go without paying your property taxes varies. Failing to pay property taxes when due can mean: When a property owner fails to pay property taxes, the county in which the. How Long Can You Go Without Paying Property Taxes In Illinois.

From marketrealist.com

How Long Can You Go Without Paying Property Taxes? How Long Can You Go Without Paying Property Taxes In Illinois You can lose your home or property if you don’t pay your residential property taxes. Fulfilling a promise of offering property tax relief for illinoisans, gov. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. If you qualify for an exemption, it allows you to. Exactly. How Long Can You Go Without Paying Property Taxes In Illinois.

From dev-taxease.stantonstreethosting.com

How Are Property Taxes Calculated in Texas Learn How Property Taxes How Long Can You Go Without Paying Property Taxes In Illinois When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Pritzker friday signed legislation easing the tax burden for some of the. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.youtube.com

How long can you go without paying property taxes in Illinois? YouTube How Long Can You Go Without Paying Property Taxes In Illinois Failing to pay property taxes when due can mean: When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. How long can. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.four19properties.com

How Long Can You Go Without Paying Property Taxes in Texas? How Long Can You Go Without Paying Property Taxes In Illinois Usually, a property won't go to tax sale if the home is mortgaged. Failing to pay property taxes when due can mean: If you qualify for an exemption, it allows you to. Fulfilling a promise of offering property tax relief for illinoisans, gov. When a property owner fails to pay property taxes, the county in which the property is located. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.prisonsinfo.com

Can You Go to Prison For Not Paying Taxes? How Long Can You Go Without Paying Property Taxes In Illinois How long can you go without paying your property taxes? You can lose your home or property if you don’t pay your residential property taxes. What is a property tax exemption? Failing to pay property taxes when due can mean: Exactly how long you can go without paying your property taxes varies. Pritzker friday signed legislation easing the tax burden. How Long Can You Go Without Paying Property Taxes In Illinois.

From johnsonandstarr.com

How Long Can You Avoid Paying Property Taxes Before Foreclosure How Long Can You Go Without Paying Property Taxes In Illinois Exactly how long you can go without paying your property taxes varies. Fulfilling a promise of offering property tax relief for illinoisans, gov. How long can you go without paying your property taxes? A property tax exemption is like a discount applied to your eav. Because property tax liens have priority over other liens, the lender or. The amount of. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.thehansindia.com

Property tax payers pay Rs 91 cr online How Long Can You Go Without Paying Property Taxes In Illinois Usually, a property won't go to tax sale if the home is mortgaged. How long can you go without paying your property taxes? When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. Exactly how long you can go without paying your property taxes varies.. How Long Can You Go Without Paying Property Taxes In Illinois.

From poweshiekcounty.org

March Property Taxes are due by March 31, 2023 Poweshiek County, Iowa How Long Can You Go Without Paying Property Taxes In Illinois A property tax exemption is like a discount applied to your eav. You can lose your home or property if you don’t pay your residential property taxes. Because property tax liens have priority over other liens, the lender or. Usually, a property won't go to tax sale if the home is mortgaged. How long can you go without paying your. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.taxuni.com

Illinois Property Taxes 2023 2024 How Long Can You Go Without Paying Property Taxes In Illinois Exactly how long you can go without paying your property taxes varies. How long can you go without paying your property taxes? Because property tax liens have priority over other liens, the lender or. A property tax exemption is like a discount applied to your eav. What is a property tax exemption? Usually, a property won't go to tax sale. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.illinoispolicy.org

Property taxes grow faster than Illinoisans’ ability to pay for them How Long Can You Go Without Paying Property Taxes In Illinois The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Usually, a property won't go to tax sale if the home is mortgaged. Exactly how long you can go without paying your property taxes varies. What is a property tax exemption? Pritzker friday signed legislation easing the. How Long Can You Go Without Paying Property Taxes In Illinois.

From www.owebacktaxesproperty.com

How Long Can You Go Without Paying Property Taxes in Texas & Nationwide How Long Can You Go Without Paying Property Taxes In Illinois Because property tax liens have priority over other liens, the lender or. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. How long can you go without paying your property taxes? Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,.. How Long Can You Go Without Paying Property Taxes In Illinois.

From pdpla.com

Proportional Property Tax Could Shift Pain To Landlords PDPLA News How Long Can You Go Without Paying Property Taxes In Illinois A property tax exemption is like a discount applied to your eav. How long can you go without paying your property taxes? When a property owner fails to pay property taxes, the county in which the property is located creates a lien on it for the amount. Because property tax liens have priority over other liens, the lender or. The. How Long Can You Go Without Paying Property Taxes In Illinois.

From abc7chicago.com

Illinois property taxes are 2nd highest in the country, report finds How Long Can You Go Without Paying Property Taxes In Illinois Fulfilling a promise of offering property tax relief for illinoisans, gov. The amount of the exemption benefit is determined each year based on (1) the property's current eav minus the frozen base year value. Pritzker friday signed legislation easing the tax burden for some of the most vulnerable residents,. Failing to pay property taxes when due can mean: A property. How Long Can You Go Without Paying Property Taxes In Illinois.